RevHub’s Tax Policy Simulator

Maximize efficiency and plan for the future by analyzing

the impact of key variables in various tax scenarios.

The complexities of assessing the impact of tax policy changes

When state policymakers are considering tax code changes, it’s critically important that they understand the effect of the legislation on overall revenue and on specific taxpayers based on geographic and demographic dimensions. However, the volume of proposed changes is soaring for most states, and existing solutions are not keeping up.

Increasing volume of proposed

changes to state tax laws

Lack of staff resources

and limited data

Interruptions to strategic

projects and initiatives

Outdated technology

and manual processes

Most states rely on sub-optimal solutions, including spreadsheet modeling, homegrown systems that require significant IT support, or small-scale, sample-based models, built by contractors to perform basic computations.

Regardless of which of these approaches is employed, analyzing proposed tax legislation often entails a significant amount of work and long turnaround times, resulting in interruptions to other initiatives and projects. This problem is acute for Departments of Revenue (DORs), where the staff that typically perform such analyses are also responsible for dozens of other statutory and non-statutory functions.

RevHub Tax Policy

Simulator

With RevHub Tax Policy Simulator (TPS), analysts can determine how proposed legislation will change state revenues, affect specific constituencies, and impact tax administration processes.

Voyatek’s RevHub Tax Policy Simulator (TPS) allows users to generate simulations of proposed changes to tax policies and fees, estimating revenue changes and identifying which constituencies will be affected and how. With TPS, policymakers and administrators can quickly assess the proposed legislation, deliver detailed reports to stakeholders about fiscal impacts, and more efficiently prepare for operational changes.

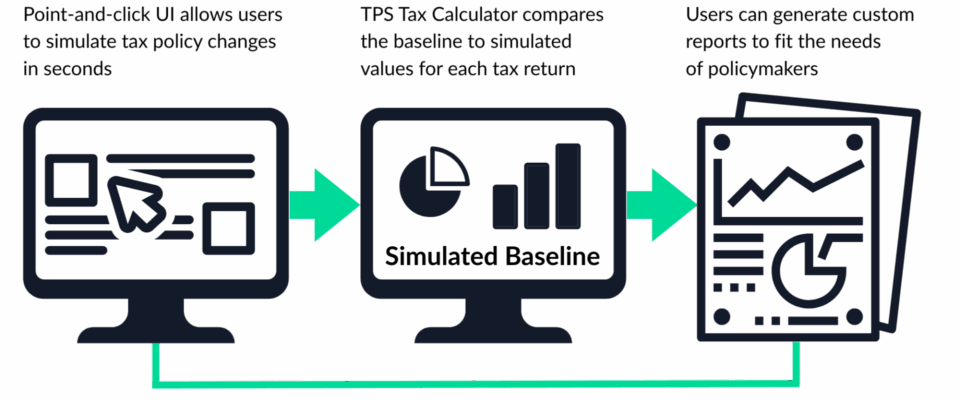

How it Works

Tax Policy Simulator’s point-and-click user interface (UI) allows users to simulate tax policy changes in seconds. The simulator uses the department’s most recent, available return filing data as the baseline and starting point. The taxpayer provided input from the baseline return are used along with the new policy parameters and logic defined by the user and the TPS Tax Calculator is used to generate a new tax liability for each taxpayer in the baseline population. User specified growth rates, down to the county and tax bracket level, can be applied to grow (or decline) the population to the desired simulation year. And users can generate custom reports comparing the simulation output to the baseline.

Flexible and Scalable

The TPS can be used for virtually any tax type and simulate a range of tax policy changes.

Tax types supported (among others):

- Personal income tax

- Corporate income tax

- Sale, use, and affiliated excise taxes

- Alcohol, tobacco, and cannabis excise and luxury taxes

- Natural resources and severance taxes

- Lodging and hospitality taxes

Simulations supported (among others):

- Adjust tax rates and tax brackets

- Adjust filing thresholds

- Add new exemptions

- Add new deductions

- Adjust standard deduction amounts

- Add new additions to income

- Add new subtractions to income

- Add new tax credits, including refundable and non-refundable

- Adjust existing tax policies

Meaningful Insights in Seconds

Once the simulation is complete, the TPS generates powerful reports leveraging Artificial Intelligence (AI), configurable to the needs of DORs and policymakers. Reports include:

- Time and date of simulation

- Output report name

- User that performed the simulation

- Itemized list and short description of tax policy changes included in the simulation

- Overall revenue effect (dollar amount) of the tax policy simulation

- Summary of taxpayers affected by tax policy changes by filing status and residency

- Number of returns affected by the simulation and revenue effect across adjusted gross income or taxable income groups, as available

- Ability to provide simulation results for smaller populations of taxpayers, such as by geography (e.g., county, city, zip code, legislative district) and/or demographic dimensions (filing status, residency) as configured for the client

Integrated AI helps users draft narratives that highlight key outcomes from the simulation. Additionally, AI surfaces unique and impactful insights from the simulation that would not otherwise be obvious to users or policymakers.

The TPS provides operational insights regarding the administrative changes that would be necessary to effectuate the simulated tax policy, if enacted by policymakers. The operational summary identifies:

- The existing tax forms and instructions that would require modification to reflect the simulated police

- The type of new forms that may need to be added to effectuate the simulated policy.

Looking Ahead

Looking ahead, the future version of the TPS will enable users to easily generate counts and dollar amounts for exemptions, deductions, income adjustments, and credits directly through the UI. This functionality will support statutory tax expenditure reporting requirements, legislative and executive branch information requests, and other tax statistics, without the need for simulation. By leveraging

final return data ingested by the TPS, users will be able to create tailored reports, including insights into smaller tax return segments based on location, filing status, residency, and other demographic factors. This added functionality, along with the key features of the TPS described above, will enhance the depth, breadth, accuracy, speed and accessibility of proposed and existing tax policies, allowing policymakers to develop and approve new policies or revise existing tax policies based on fact-based and data-driven insights, while boosting the productivity of users to deliver timely and accurate analyses to decision-makers.